S-Corporation Disquised Wage Payment

Question: Is a dividend distribution from a sole-shareholder S-Corporation a disguised wage payment?

As with any economy, businesses are continually seeking to increase the bottom line of their profit statements. One such method is for the employer to reclassify its employees as independent contractors. The benefits are obvious wherein the employer no longer has to contribute to the payroll tax of the employees, paid vacations, paid sick leave, paid holidays, employee benefits and employee pensions as well as other expenditures paid by an employer for the benefit of the employee.

Generally, the employees are helpless with the employer’s decision to reclassify them as independent contractors and are then compelled to report their wages as independent contractor income. The reclassified employee will no longer receive the usual Wage and Earning Statement, W-2, from the employer. The reclassified employee will receive a form 1099-MISC showing their wages as taxable income that must now be reported as a Sole Proprietorship on Schedule C of their tax return. The net profit shown on this Schedule C will not only be subject to Federal and State income taxation at ordinary income tax rates but also subject to Federal Self-Employment tax rate on Form 1040-SE. In other words, the reclassified employee will be paying two forms of taxes on their tax return; (1) ordinary income tax, and (2) self-employment tax which replaces both the employers’ part and the employees’ part of payroll tax liabilities. Thus, you are responsible for both the employer and employer portions as compared to the period prior to the re-classification when you were only responsible for the employee’s portion.

Now the reclassified employee, hereinafter referred to as “RE” is facing a reduction of the employee benefits and an increased burden of reporting and paying additional self-employment taxation, new tax filing forms, massively significant increase in IRS, State and Employment Development Department examinations.

So what is the RE to do? Generally, the RE will need to seek out the advice of a tax advisor who may suggest that the RE set up a corporation, elect S Corporation tax status, pay one’s self a wage and recharacterize the above mentioned 1099-MISC income as part wage payments and part dividend payments.

Why bifurcate your 1099 MISC income?

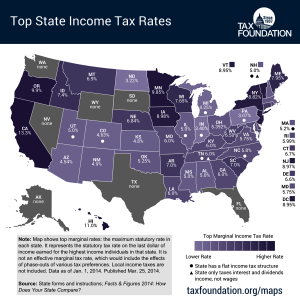

Well, that is because of your ordinary income tax rates for 2015 which range from 10% to 39.6% depending on your level of income. So, if all of your 1099-MISC income was taxable, your tax burden will rise sharply and quickly hit the ceiling at 39.6%, see the tax table below. Of course, this 39.6% is not your only income tax burden. The state that you reside within will also want its share of state income taxes, unless you live in the following States with no or little income taxes:

States with no income tax:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

States with nearly no income tax:

- Tennessee

- New Hampshire

Then there are the other States; California is at the highest tax rate for 2015 at 13.3%. If you add up the Federal ordinary income tax rate at 39.6% and California at 13.3%, that is a staggering 52.9% of taxation on your newly re-characterized 1099-MISC income and then add the 2015 self-employment tax of 15.3% on the first $118,500 of net income and 2.9% on the net income that is in excess of $118,500 and your tax takes over more than 2/3 of your overall income! In other words, just before noon on Thursday of each week, you will begin to have your weekly earnings that are now spendable by you.

American’s have always been inventive and this situation is no different. When faced with this level of taxation and because your employer has unilaterally decided to reclassify you as an RE, you will seek options to reduce the tax burden and enjoy your spendable money before Thursday noon of each week. This is where the caution comes in!!!

Ill-gotten advice is given to these RE to merely set up a corporation, elect S Corporation status and make a portion of your 1099-MISC income characterized as wages subject to income tax and self-employment tax as I discussed above. The remainder of the 1099-MISC income will be classified as a dividend and subject to a much lower overall Federal tax rate between 0% to 20%. That’s an immediate Federal tax savings of over 30%! Now don’t get too excited and begin setting up your corporation for the tax savings. I do agree that corporations are extremely useful to a new RE. Corporations help limit liabilities, have indefinite lives, help organize your business into a formal business model, mitigate the possible IRS tax audit exposure, very useful for estate planning and brings perceived legitimacy to your business. However, please use the test of reason and realize that the IRS has established rules for claiming dividend income, especially for newly RE individuals.

Lets take your situation. You were an employee, now you are an independent contractor receiving 1099-MISC income. You still have one boss who is now your sole client. Your pay is the same, just recharacterized as 1099-MISC income and not Wage and Earnings Income. You still report to the boss. You may still go to the same office and do the same work, which the boss will direct, review and give you evaluations. You may even have the same business cards, same parking lot space, same employer provided smart phone and the same business clientele. Face it, you are still an employee and until a co-worker is terminated or resigns and goes to the Employee Development Department for unemployment compensation claiming “employee” status…an IRS examination is looming for you and your employer. Certainly the IRS and the State will examine your income status and determine that the dividend income that your faithfully reported on your tax returns is really wages and you are then assessed with increased tax liabilities for as many years as allowed under the relevant Statute of Limitations including penalties for negligence and accuracy as well as their compounding effect of interest on the additional tax and penalties. Then, the IRS or the State will inform each other of the findings so you will be subject to both IRS and State taxation, penalties and interest…a heavy financial bullet to your financial health.

Still not convenienced, don’t take my word for it since your advisor will reassure you the dividend choice is still the smart decision; look at the published IRS view, http://www.irs.gov/taxtopics/tc404.html

“…a shareholder that provides services to a corporation may be deemed to receive a dividend if the corporation pays the shareholder service-provider in excess of what it would pay a third party for the same services.”

In our fact situation, you still are the only shareholder, director and/or officer in the newly formed corporation and you are the only person using your efforts to produce income, which is from the same entity that was just recently your employer. Therefore, your true characterization of the 1099-MISC income is that of wages, not excess earnings as you may have been led to believe.

CONCLUSION:

If this fact situation is similar or identical to yours, please give us a call and we will help you understand this very complex tax situation and offer plausible solutions.

Michael Nelson, Esq.

2015 Estimated Income Tax Brackets and Rates

Provided by the Tax Foundation – Click here